Private labels in the mind of the consumer

Encodify

8 min read

The current volatile environment has become a new retail reality with rising private label demand, complex supply chain disruptions and inflation taking hold. Thus, it is more important than ever that retailers ensure that their private label strategies are up to date and meet the expectations of today’s and tomorrow’s consumers. But when navigating in a retail landscape shaped by tomorrow, how do retailers know which way to go? We have digested the latest data to give you insights.

According to IRI (Information Resources, Inc.), private labels make up 35 % of total FMCG value sales in Europe. This equals €194 Bn[1]. And in these uncertain inflationary times where the Ukrainian war, shortage of raw materials, finished goods and workers, private labels have the potential to increase this percentage. One reason for this is that, when faced with a long list of challenges, retailers can rely on one constant variable: consumer needs and values to drive purchasing. Another is that – in the eyes of the consumer – many private label brands have evolved from being fill-in lower price alternatives to now representing value for money with brand-asset status.

Recent studies from IRI show that private labels have narrowed the gap with National brands in categories such as innovation, quality, trust, good for the environment, delivering claims and even image. All in all, more private labels provide high quality at a lower price than national brands. Many retailers are transforming the typical 1980s perception of private label products as generic products toward private label brands with their own brand strategies with great success.

Thus, it is safe to say that when it comes to navigating the private-label landscape, the mind of the consumers is a vital roadmap. However, with many retailers still navigating the compounding complexities, where should they shift their focus and place their bets?

Due to a lot of research, we believe that especially three factors are essential to look into:

- Prioritise private label brand innovation

- Develop a holistic private label brand multichannel experience

- Rethink the supply chain foundation

Here is why.

Prioritise private brand innovation

Retailers must revitalise their private label brand 'innovation strategies' yesterday rather than tomorrow or risk falling behind the competition to meet changing consumer expectations and maintain brand and banner relevancy in the long run. To do this, retailers must first and foremost strive to capitalise on already existing brand trials and trust.

The consumer landscape in private labels has changed dramatically within the last couple of years. According to IRI, the proportion of private label loyalists – consumers who prefer private labels over national brands – now equals those of national brands in all key European markets[2]. According to Daymon, 89% of US consumers trust private label brands just as much as national brands[3]. With this trust established, consumers are prone to trying additional products within a retailer's portfolio.

Another reason why innovation is essential within private brand strategy today is when establishing differentiation. Comparative studies show that competing retailers' assortments overlap as much as 98%, meaning national brand assortment is no longer a deciding factor for banner choice. Private label brands can offer shoppers items that can only be purchased from them, resulting in consumers returning for their unique and differentiated offerings.

Moreover, innovation should be a part of a private label brand strategy to maintain consumer loyalty. Private label brand innovation's most significant advantage is its ability to extend loyalty beyond the portfolio, with stronger private label brands creating brand-loyal consumers. According to research, 75 % of loyal US private label brand loyalists have a preferred store where they shop, while 48% of UK consumers agree that the private range is crucial when deciding where to shop[4].

Overall, private brand strategy can make or break banner loyalty; how much and how retailers prioritise innovation within their strategies will determine their future success.

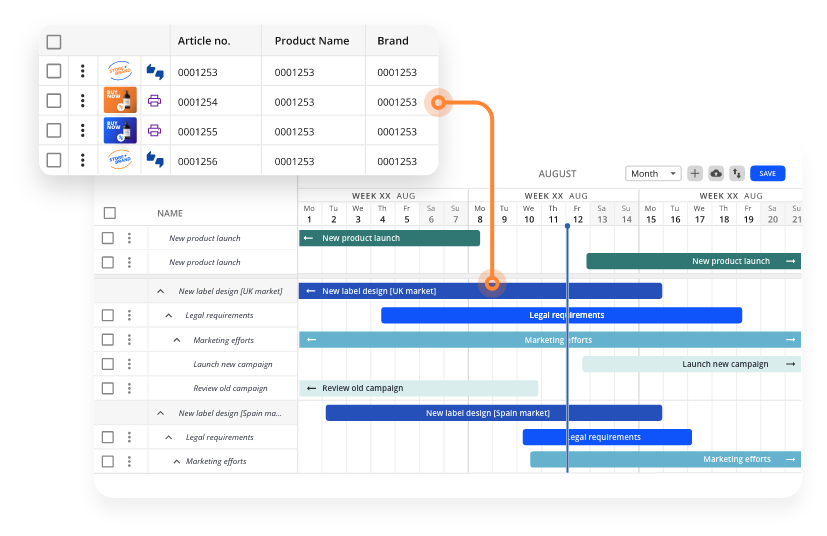

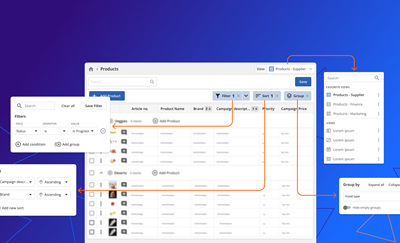

Managing the process, and the increasing numbers of SKUs in a timely manner (getting the right product to the right store - on- or offline as we shall see later - at the right time and the right place) is a question of connecting people, processes through technology utilising best-practice solutions.

Develop a holistic private brand omnichannel experience

Focusing on multichannel within retailer strategy is not a new thing. However, during the pandemic, the world saw how e-commerce and the digital landscape were shaped by multichannel. As consumer needs changed suddenly, retailers had to shift gear and adapt to the evolving purchasing behaviour of the new multichannel consumer. This tendency is still going strong. So when creating and branding private label brands, it is crucial to be aware of how, when and where consumers shop.

Previously, consumers might start a potential online buying process and finish it online at the same channel. Now consumers consistently purchase across multiple digital platforms, starting the buying process online and ending it in a store or visa versa. With this increased blend of digital and e-commerce, retailers must ensure private label brands are appropriately positioned in this hybrid world.

This could start with ensuring that private label brands are fully represented within a retailer's e-commerce platform; consumers can't buy what isn't there. Private label brands must be fully represented online in display and search.

Creating an integrated strategy that includes merchandising, product information, package design, and cross-channel marketing is critical to ensuring private label brand multichannel success.

Furthermore, when creating a holistic private label brand multichannel experience, it is crucial to ensure coherence through the retail channels, both online and offline. eMarketer estimates worldwide retail online sales in 2022 will reach $6.169 trillion, making up just a 22.3% share of total retail sales[5]. Therefore, the 80:20 principle applies to the current status of 'bricks' versus 'clicks', with the vast majority of retail sales revenues still being generated by 'bricks-and-mortar' stores. So, suppose retailers fail the opportunity to involve in their physical stores. In that case, they will miss out on a massive potential reward, and the idea of a holistic multichannel has failed.

Another crucial step to ensure private label brand multichannel success is that retailers must develop integrated strategies that include appropriate merchandising, product information, package design, and marketing across channels. Key learnings from online strategy can also be applied in-store, blurring the lines between channels and establishing the truly consistent multichannel and digitally-enhanced shopping experience consumers expect.

There is no universal "all-ways-leads-to-Rome" solution when rethinking the global supply chain challenges.

Rethink the supply chain foundation

As the world continues to experience supply chain challenges such as lockdowns, labour shortages, and escalating raw material costs, there are vital lessons retailers can take from current supply chain challenges to proactively manage their supply chain and private label brand strategies in the future. This could potentially help minimise complications and errors when looking ahead.

The pandemic has revealed how interconnected all aspects of the supply chain are, making collaborations between suppliers and retailers critical in identifying pitfalls and devising mutually beneficial solutions.

Still today, industries across the retail landscape are grappling with challenges across the board, from a shortage of workers and closed factories to transportation bottlenecks and rising commodity prices. When combined with external forces such as climate change and geopolitical conflicts, these will continue to experience tensions. Private label brands have surely felt the impact of these challenges and have had to shift focus to address these immediate issues.

Thus, retailers must also be proactive in managing their supply chain and private label brand strategies when trying to drive forward in the private label brand lane, steering towards future consumer needs. We see the following three as the essential pedals: Supplier networks, pricing, and marketing. Here is why.

Supplier network: Retailers must identify and support critical areas of the business through long-term strategic partnerships to improve their collective ability to support the private label brand strategy and future crises.

One advantage can be ensuring preference in order fulfilment; some retailers are shifting away from imposing strict penalties instead of creating a more appealing environment by reducing cash terms or nuisance fees to encourage rather than penalise. Another advantage is increased innovation; some retailers collaborate with suppliers to create new or exclusive items, a mutually beneficial endeavour that distinguishes the retailer's assortment from competitors while creating an exclusive segment for the supplier.

Retailers should consider diversifying their supplier network in the long run. Supplier centralisation has been driven by many factors, including avoiding vendor management complexity, aggregating purchases to scale, and navigating government regulations or incentives. On the other hand, retailers should weigh the benefits of expanding these networks to go beyond cost-driven commoditisation for future supply chain concerns and overall business strategies. A more diverse supply base does lend itself to greater variety and more opportunities to develop a niche and interesting products - if this can be managed effectively. Often retailers opt for simpler, pared-down solutions because they are more manageable. Such solutions can be highly beneficial - enabling retailers to manage greater complexity more simple and effective.

Pricing

A relevant aspect to consider is whether or not to implement consumer-facing price changes. According to Daymon, 70% of global consumers think that food-beverage prices have risen since mid-2021[6]. It is important to note that while retailers may be under pressure to pass on internal cost increases, determining the best approach should not be based solely on short-term gains and losses. On a category-by-category basis, a variety of factors should be considered in this calculation, including price elasticity, consumer willingness to pay, category dynamics, national brand pricing, target price gaps, and brand positioning.

Marketing

While retailers should mitigate these challenges as much as possible through supplier networks and pricing strategies, they should also be proactive in communicating these challenges to consumers to nurture transparency and trust. This could be related to out-of-stocks, pricing, or other issues. Many European retailers, for example, provide transparency in their pricing breakdowns to ensure consumers understand where their money is going.

Other retailers have committed to price freezes and are marketing them to encourage long-term consumer loyalty rather than short-term stockpiles and panic buying.

Finally, emphasising private brands as a solution for consumers as they navigate the impact of these challenges is an underlying opportunity that will drive long-term positive impact.

Rather than believing in a universal solution, retailers should select messages that support their brands' positionings. The emphasis on price and savings may be best for some private brands.

Some consumers are still facing significantly reduced incomes, and private brands can provide the ability to enjoy quality items across all categories. Others may benefit from encouraging trial - for example, by substituting in-stock private brand items for out-of-stock items - through endcaps, displays, and recipes, which can highlight private brands' variety and ability to meet a variety of lifestyles.

Conclusion

Retailers must rethink their private brand innovation strategies or risk falling behind the competition to meet changing consumer expectations and maintain brand and banner relevancy in the long run. Over the last two years, private brand trails have increased trust and loyalty, extending beyond the portfolio to the banner. To capitalise on this trust, retailers must prioritise private brand innovation and look at all tiers and categories that could benefit from innovation, not just those driving purchasing.

Moreover, during the pandemic, consumers quickly adopted new purchasing habits, resulting in a surge in online shopping. Today, consumers shop across channels based on their individual purchasing needs, so private label brands must market across multiple channels. However, in 2022 worldwide retail online sales will reach $6.169 trillion, making up just a 22.3% share of total retail sales. So if retailers fail to create multichannel customer experiences, they will miss out on a massive opportunity to increase sales.

When looking at the supply chain, retailers must learn from experience and try to rethink the construction so it benefits the private label brand strategy in the best way possible. As costs rise, retailers should update their purchasing strategies to mitigate some of these increases, working within these strengthened partnerships to control input costs and determining whether any consumer-facing price changes are necessary. Finally, retailers must be proactive in communicating supply changes to consumers, providing an opportunity to create transparency, build trust, and expand private brand trails.

Overall, there are many unknowns in retail, especially in a volatile environment as many are experiencing today. When faced with a long list of challenges, retailers can rely on one constant variable: consumer needs and values drive purchasing.

Thus, retailers must ensure that their private label brand strategies are up to speed to meet the expectations of today's and tomorrow's consumers and to ensure a roadmap when navigating a volatile retail landscape.

Sources

[1] iriworldwide.com/IRI/media/IRI-Clients/International/Private-Labels-Deck.pdf

[2] IRI Private Label Consumer Survey, February 2021; Private Labels: Hiding in Plain Sight. No longer cheap, generic, look-alike Substitutes. They are your biggest Competitor, 2022

[3] daymon.com/wp-content/uploads/2022/05/THE-FINAL-2022-Private-Brand-Intelligence-Report.pdf

[4] daymon.com/wp-content/uploads/2022/05/THE-FINAL-2022-Private-Brand-Intelligence-Report.pdf

[5] emarketer.com/content/worldwide -ecommerce-continues-double-digit-growth-following-pandemic-push-online

[6] daymon.com/wp-content/uploads/2022/05/THE-FINAL-2022-Private-Brand-Intelligence-Report.pdf